There were no tests of the levels I outlined in the first half of the day. Even with the release of important inflation data from the UK, reduced market volatility prevented the pair from reaching those key levels.

The published data showing a slowdown in inflation in the United Kingdom for March restrained the pound's strengthening against the U.S. dollar. It became evident that such data gives the Bank of England more room to continue its monetary easing policy—that is, further interest rate cuts—which negatively affects the pound's near-term position. Nonetheless, the overall economic situation in the UK remains relatively stable, offering some support to the pound. The labor market continues to show resilience, and the unemployment rate remains low. This, in turn, supports consumer spending and overall economic activity.

Several important U.S. economic reports are scheduled for release in the second half of the day. Retail sales data will provide insights into consumer spending, a primary driver of the U.S. economy. An increase in retail activity may reflect improved consumer sentiment and economic acceleration, while a drop would suggest the opposite. Changes in industrial production are also important indicators of economic health. Growth in this area often signals increased demand for goods and services, which can lead to job creation and greater investment.

Strong U.S. data may lead to a sell-off in the British pound. However, the main event will be Jerome Powell's speech. Investors will closely follow his comments for signals on the Fed's future monetary policy. Any hints of possible rate cuts could weigh on the dollar.

As for the intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

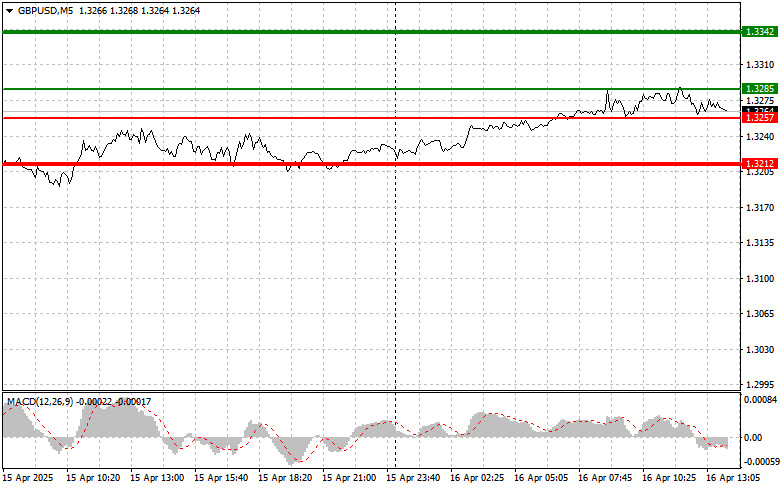

Scenario #1: I plan to buy the pound today at an entry point near 1.3285 (green line on the chart), targeting a rise to 1.3342 (thicker green line on the chart). Around 1.3342, I'll exit long positions and open shorts in the opposite direction, aiming for a 30–35 point pullback. Pound appreciation today may continue as part of the overall bullish trend. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3257 level while the MACD is in oversold territory. This will limit the pair's downward potential and may lead to a market reversal. A rise to the opposite levels of 1.3285 and 1.3342 is then expected.

Sell Signal

Scenario #1: I plan to sell the pound after a breakout below 1.3257 (red line on the chart), which could lead to a rapid decline in the pair. The primary target for sellers will be 1.3212, where I'll exit short positions and open immediate longs in the opposite direction, aiming for a 20–25 point pullback. Sellers are likely to step in if U.S. data is strong and Powell maintains a hawkish stance on inflation. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3285 level while the MACD is in overbought territory. This will limit the pair's upward potential and may trigger a reversal. A drop to the opposite levels of 1.3257 and 1.3212 is expected.

Chart Key:

Important Note:

Beginner Forex traders should exercise extreme caution when making market entries. It's best to stay out of the market ahead of major fundamental reports to avoid sudden price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you could lose your entire deposit very quickly—especially if you don't apply proper money management and trade large volumes.

And remember: successful trading requires a clear trading plan—like the one I've outlined above. Making spontaneous decisions based on the current market situation is, from the outset, a losing strategy for an intraday trader.