Největší indická soukromá ropná a plynárenská společnost Cairn India uvedla, že v rámci plánu v hodnotě 5 miliard dolarů na pětinásobné zvýšení produkce v nadcházejících letech může investovat do amerických servisních a inženýrských společností, uvedl v úterý její předseda.

„Chci vynaložit 5 miliard dolarů na rozvoj svého projektu, abych se dostal na produkci 500 000 barelů denně,“ řekl miliardář Anil Agarwal v rozhovoru pro agenturu Reuters.

Společnost Cairn, která je součástí společnosti Vedanta (NYSE:VEDL) Limited, dnes produkuje 100 000 barelů denně. V příštím roce plánuje provést několik hlubokomořských průzkumných vrtů.

Agarwal během návštěvy Houstonu, kde se zúčastnil konference CERAWeek, uvedl, že společnost Cairn usiluje o spolupráci se 7 nebo 8 technickými partnery a o nákup 5 nebo 6 vrtných souprav pro průzkum a rozvoj projektu na moři.

„Chceme realizovat 500 až 600 nových vrtů, chtěli bychom, aby na našem poli pracovalo alespoň 20 vrtných souprav,“ řekl Agarwal.

„Mohu investovat do inženýrské společnosti, do společnosti vyrábějící vrtné soupravy, protože to mi pomůže k lepšímu průzkumu v Indii,“ řekl.

„Byl bych rád, kdyby se americké společnosti spojily a ujaly se tohoto projektu.“

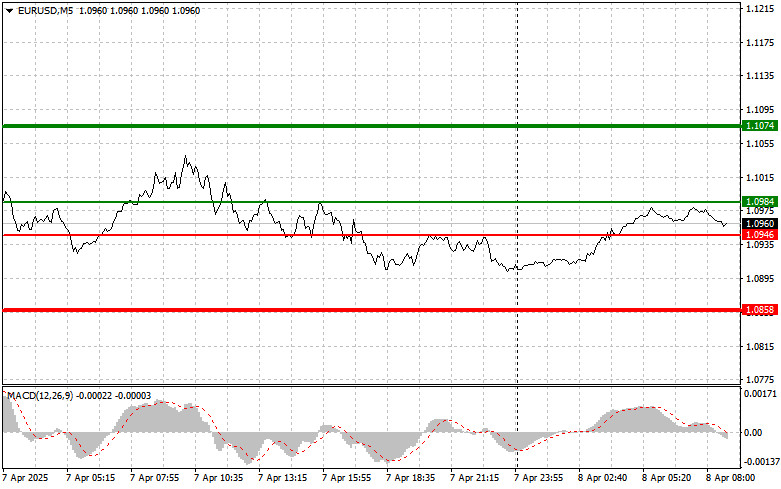

The price test of 1.0946 occurred when the MACD indicator had just started moving down from the zero mark, confirming it as a valid entry point for selling the euro. As a result, the pair fell by 30 pips.

The disappointing eurozone retail sales data released the day before and an emergency Federal Reserve meeting—likely prompted by problems in the U.S. stock market—contributed to the dollar's rise against the euro. The dollar may continue to strengthen in the near term as the challenges many countries face due to U.S.-imposed trade tariffs are expected to intensify.

Today, the news calendar is quiet, with France's trade balance being the only notable release. This indicator, reflecting the difference between a country's exports and imports, is a key measure of France's economic health but has little direct impact on the forex market or the euro itself. A positive balance (exports exceeding imports) supports the national currency, creates jobs, and contributes to economic growth. A negative balance indicates that a country imports more than it exports.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1:

Buy the euro today upon reaching the price area of 1.0984 (green line on the chart), with a target of rising to 1.1074. At 1.1074, I plan to exit the market and open a short position in the opposite direction, aiming for a 30–35 pip move from the entry. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2:

Also, I plan to buy the euro today in case of two consecutive tests at the 1.0946 level while the MACD is in the oversold zone. This would limit the pair's downside potential and lead to an upward reversal. A rise toward 1.0984 and 1.1074 can be expected.

Scenario #1:

I plan to sell the euro after it reaches the 1.0946 level (red line on the chart). The target will be 1.0858, at which point I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 pip move from that level). Selling pressure could return quickly today.

Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to fall.

Scenario #2:

Also, I plan to sell the euro today if there are two consecutive tests of the 1.0984 level while the MACD is in the overbought zone. This would cap the pair's upside potential and lead to a downward reversal. A drop toward 1.0946 and 1.0858 can be expected.