Futures on U.S. stock indices have slightly recovered today after yesterday's significant decline. The S&P 500 is currently trading with a slight loss, while the NASDAQ is hovering around zero. Shares of Chinese technology companies surged, marking their strongest move in the past three years, which spurred gains across the Asian markets. This rally was driven by optimism surrounding artificial intelligence (AI) developments. The Hong Kong-listed tech stock index rose, led by a 14% jump in Alibaba's shares. Meanwhile, European index futures saw a slight decline.

While investors remain concerned about rising geopolitical tensions and the expanding tariff war, Alibaba and other Chinese tech stocks have gained traction in recent weeks due to enthusiasm around the DeepSeek AI model. This rally reflects not only hopes for technological advancements but also China's broader push for self-sufficiency in key tech sectors. DeepSeek, developed as part of Beijing's efforts to reduce reliance on Western technologies, is seen as a potential competitor to models from OpenAI and Google. If successful, DeepSeek could strengthen the global position of Chinese companies in the AI sector and reduce the influence of foreign firms.

Whether DeepSeek can fully match or surpass the capabilities of Western counterparts remains uncertain, but its emergence has already significantly impacted China's tech sector. Many economists believe that China will undergo major structural reforms, and the recent market upswings may continue.

Following the stock surge, Alibaba's CEO Eddie Wu stated that AI development is now the company's primary goal. "The firm intends to continue developing models that push the boundaries of intelligence," he told investors during an earnings call.

On Friday, Japan's inflation data showed an increase. Consumer prices, excluding fresh food, rose by 3.2% year-over-year in January, marking the highest gain since June 2023. This reinforces expectations of further rate hikes by the Bank of Japan, with traders pricing in an 84% probability of a 25-basis-point hike in July. However, comments from Governor Ueda caused some market uncertainty, as he reaffirmed the central bank's longstanding commitment to stabilizing the bond market.

In commodities, oil posted its largest weekly gain since early January amid growing supply uncertainties. Gold recorded its eighth consecutive weekly gain, driven by rising safe-haven demand due to geopolitical and trade tensions.

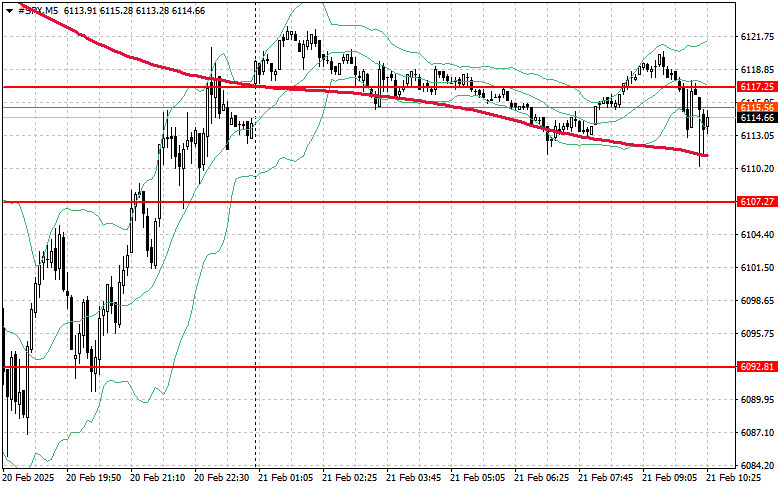

Demand for the index remains strong. Today, buyers will focus on overcoming the nearest resistance at $6,117, which would allow for a continuation of the upward trend and potentially push the index toward $6,127. A key priority for bulls will also be maintaining control over $6,152, which would further strengthen their position.

If the index moves lower due to weaker risk appetite, buyers must assert themselves around $6,107. A break below this level could quickly send the instrument back to $6,092, opening the door for a further decline to $6,079.