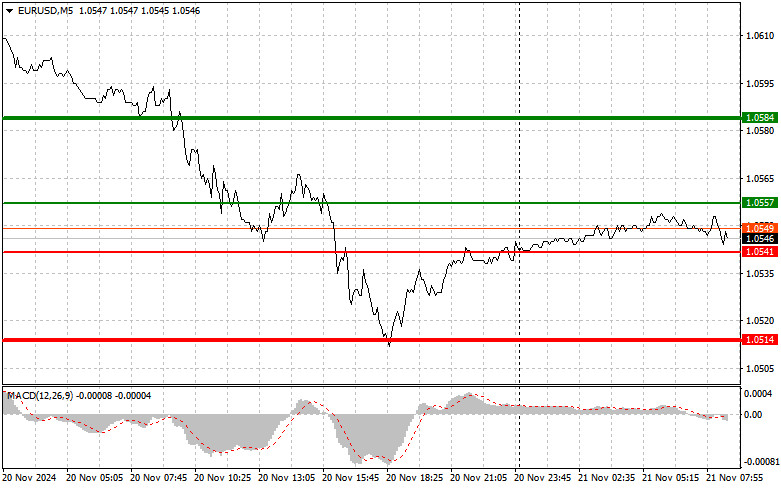

A test of the 1.0541 price level occurred when the MACD indicator had just begun to move downward from the zero mark, confirming a valid entry point for selling the euro within the downward trend. As a result, the pair dropped by more than 30 pips but failed to reach the target level of 1.0501.

Eurozone consumer confidence data is scheduled for release today, with expectations of a decline. If the data comes in worse than economists' forecasts, it could trigger a new sell-off for the euro, alongside any dovish comments from European Central Bank representatives.

The markets will closely monitor the speeches of Piero Cipollone and Frank Elderson. If policymakers hint at further interest rate cuts, it will likely put additional pressure on the euro. Traders will be looking to gauge the tone of their statements to understand whether the ECB is prepared to take extra measures amid challenging macroeconomic conditions and the risk of another surge in inflation. Lower rates would make the euro less attractive to investors, weakening the currency further. Moreover, rate cuts might fuel inflationary expectations, creating additional economic uncertainty. Amid market volatility, further euro weakening could significantly impact many economic dynamics within the region.

Regarding intraday strategy, I will primarily focus on Scenario #1 and Scenario #2.

Scenario #1:

Today, I plan to buy the euro if the price reaches the 1.0557 area (green line on the chart) with a target of 1.0584. At 1.0584, I plan to exit the market and sell the euro in the opposite direction, aiming for a movement of 30-35 pips from the entry point. A euro rise today in the first half of the day is only likely following very positive data and within the framework of an upward correction. Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario #2:

I also plan to buy the euro today in case of two consecutive tests of the 1.0541 level, with the MACD indicator in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upwards. A rise to the opposite levels of 1.0557 and 1.0584 can be expected.

Scenario #1:

I plan to sell the euro after the price reaches 1.0541 (red line on the chart). The target will be 1.0514, at which point I plan to exit the market and immediately buy in the opposite direction (targeting a movement of 20-25 pips in the opposite direction). Selling the euro is best done at the highest possible levels. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2:

I also plan to sell the euro today in case of two consecutive tests of the 1.0557 level, with the MACD indicator in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.0541 and 1.0514 can be expected.