The S&P 500 recorded its best daily rally in the past six weeks, while the Nasdaq 100 experienced its strongest performance since May, as expectations for a December monetary policy easing by the Fed rose to 81%. The futures market fluctuates between extremes, alternating between disbelief in a federal funds rate cut and complete conviction in such an event. As a result, a safety cushion once again emerges for the broad stock index.

Dynamics of US Stock Indices

FOMC member Christopher Waller insists on continuing the monetary expansion cycle by the end of the year. In his view, inflation is not a major concern, but rising unemployment could escalate exponentially. Therefore, the Fed has no choice but to continue lowering rates and supporting the labor market. The central bank is not the only entity throwing a lifeline to the S&P 500. Investors have almost forgotten about the so-called Trump put. The US president occasionally shares good news that has previously helped boost the broad stock index. This time, he mentioned a very positive conversation with Xi Jinping and stated that he intends to visit China in April.

Greed is gradually returning to the stock market, although Fear has not completely vanished. UBS Securities believes that a sell-off in equities has concluded. The combination of the stock market reset and increased odds of easing monetary policy from the Fed will pull the S&P 500 up. On the other hand, the caution expressed by Yardeni Research, one of Wall Street's most vocal bulls, suggests that not everything is as rosy as it seems. The firm indicated that it no longer expects the broad stock index to reach the 7,000 mark by the end of 2025.

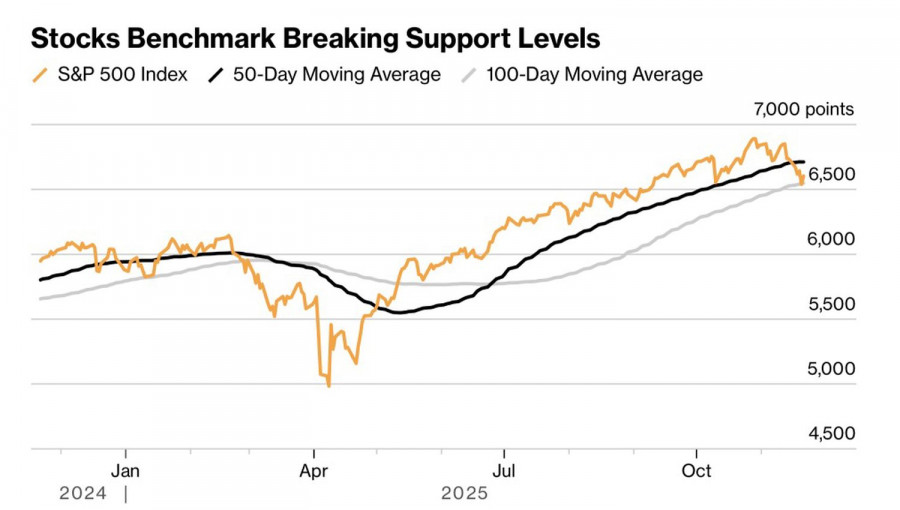

Dynamics of S&P 500 and Moving Averages

Both bears and bulls hold firmly to their views, supported by the S&P 500's crossing with moving averages. While the market has managed to return above the 100-day EMA, it continues to trade below the 50-day EMA, which is a troubling signal.

Fears about the AI bubble have receded, but they have not entirely disappeared. Bank of America claims that spending by Microsoft, Amazon, Alphabet, and Meta Platforms on AI will rise from $228 billion to $344 billion in 2025. They may not be seeing the returns that investors had hoped for. However, there are positive aspects to consider. Without spending on AI technologies, investment—a key component of GDP—would be growing at the same pace as it did in 2019.

Without the S&P 500's rally, Americans would be poorer and spend less, and the US economy might have slipped back into a recession. AI is expected to drive growth in the third quarter by 4.2%.

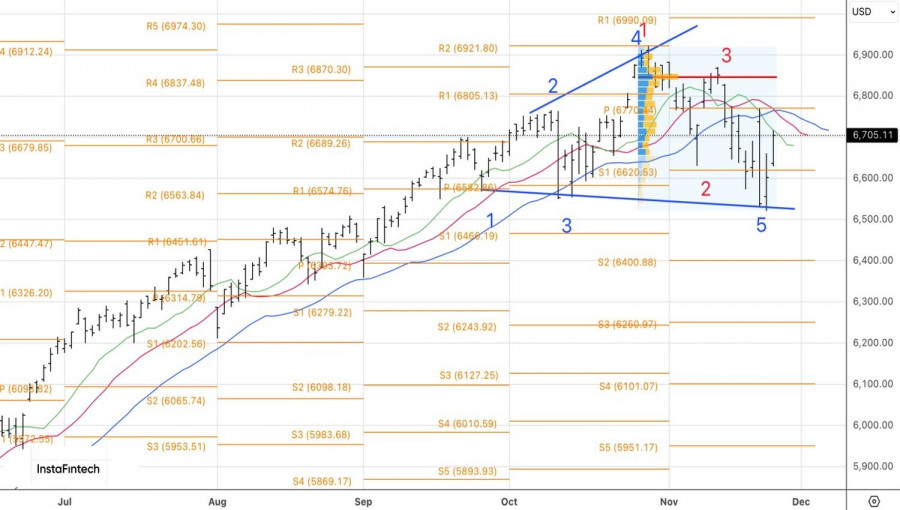

Technically, on the daily chart of the S&P 500, the pivot level is marked at 6,770. If bears manage to hold quotes below this level, the risks of a correction will increase, and traders should maintain a focus on selling. Conversely, a break above 6,770 will allow for a return to buying.

QUICK LINKS