The European Central Bank surprised no one and allowed markets to continue what they had been doing after the FOMC meeting—buying the US dollar. The deposit rate was kept at 2% for the third consecutive time. The Governing Council noted that a reliable labor market, solid household balances, and a cycle of easing monetary policy remain key elements of the Eurozone's economic resilience. In the third quarter, the Eurozone expanded by 0.2% quarter-on-quarter, more than Bloomberg experts expected.

France primarily deserves credit for this. Its GDP rose by 0.5% due to strong domestic demand and trade. Spain's stable performance added fuel to the fire. Portugal impressed with a growth of +0.8%. The Netherlands grew confidently by 0.4%. On the contrary, the gross domestic products of Ireland, Finland, and Lithuania decreased.

In the accompanying statement, the ECB did not overlook the constraining factors. Geopolitical tensions and unfinished trade disputes were among them. According to Christine Lagarde, a strong euro and high tariffs are holding back GDP growth. At the same time, she noted that the trade agreement between the EU and the US had positively impacted economic activity.

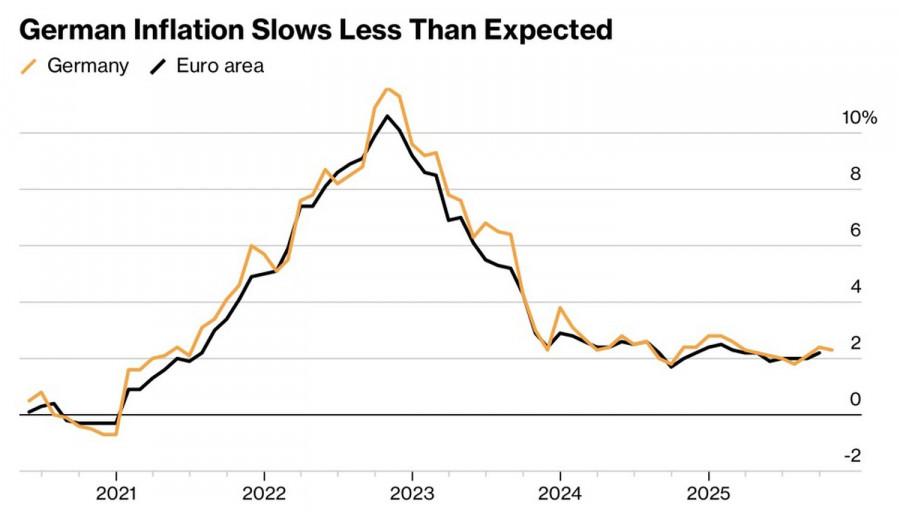

Thus, the ECB in October appeared to be pouring water from an empty into a void. The central bank said nothing new, which, against the backdrop of slowing German inflation, further convinced investors about the end of the monetary easing cycle. The derivatives market gives a 50% chance of a deposit rate cut by September 2026. A long pause theoretically should benefit EUR/USD. However, investors are currently reacting not to Frankfurt's inaction but to Washington's caution.

Jerome Powell compared the Federal Reserve to a driver navigating through fog. There is no visibility at all due to the lack of data amidst the shutdown, requiring a reduction in speed. This implies that the federal funds rate may not decrease in December. Derivatives have reduced the chances of easing monetary policy at the last FOMC meeting in 2025 from over 90% to 70%. This trend allows the US dollar to spread its wings.

EUR/USD is not benefiting from the conclusion of a trade agreement between the US and China. The reduction of tariffs in exchange for the easing of export controls on rare earth minerals and American soybean purchases allows the global economy to breathe a sigh of relief. The euro is the currency of optimists; the meeting between Donald Trump and Xi Jinping should have appealed to it. However, markets are currently fixated on reassessing the trajectory of the federal funds rate, which is a plus for the US dollar's karma.

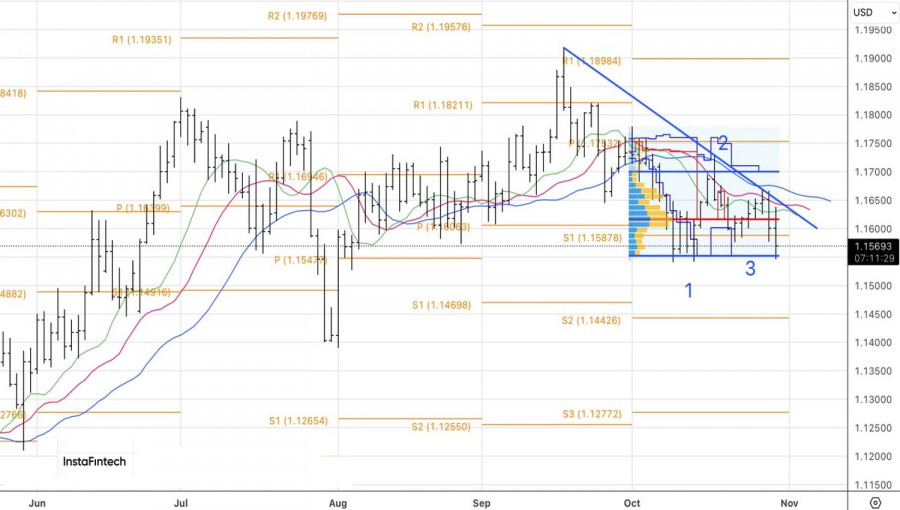

Technically, on the daily chart, EUR/USD is consolidating within the fair-value range of 1.1550-1.1700. A rebound from resistances at 1.1590 and 1.1615 is a reason for selling. Similarly, a successful breach of support at 1.1550 will also present a selling opportunity.

QUICK LINKS