Yesterday, US stock indices ended in positive territory. The S&P 500 rose by 0.58%, and the Nasdaq 100 strengthened by 0.89%. The Dow Jones Industrial Average added 0.31%.

Asian indices, along with futures on European and US equities, moved higher amid plans for a meeting between Donald Trump and Xi Jinping, which helped ease concerns about the ongoing trade war. US Treasury bonds showed stable performance ahead of the release of key US inflation data.

Markets were encouraged by the prospect of dialogue between the leaders of the world's two largest economies. Investors, worn down by prolonged uncertainty in trade relations, now see a glimmer of hope for resolving the conflict. The anticipated Trump–Xi meeting served as a powerful growth catalyst, especially evident in the technology sector, which is particularly sensitive to trade tensions. However, despite the positive momentum, caution remains. A true resolution to the trade conflict is a complex and lengthy process, and any disappointing developments or a shift in tone could quickly send markets back into pessimism.

Today's release of US inflation data remains a critically important event that could determine the Federal Reserve's next policy steps. Strong inflation figures may prompt the Fed to adopt a more cautious stance, which in turn could have a negative impact on economic growth and trigger another wave of volatility in the stock market. A decline in inflation, on the other hand, would support a more accommodative Fed stance.

As mentioned earlier, the MSCI Asia Index rose by about 0.4%, resuming its sharp upward movement. Among the key drivers were technology stocks: South Korean chipmaker SK Hynix Inc. jumped by 6.9%. In China, semiconductor shares also led gains, as the country renewed its focus on technological self-reliance. The technology-focused STAR 50 Index surged by more than 3%.

Oil prices fell ahead of the US inflation report. The US dollar edged higher, while gold prices declined. The yen sell-off intensified after Japan's finance minister hinted that the country may need to issue additional bonds to finance the upcoming economic stimulus package proposed by Prime Minister Sanae Takaichi. The yen weakened against the US dollar for a sixth consecutive session.

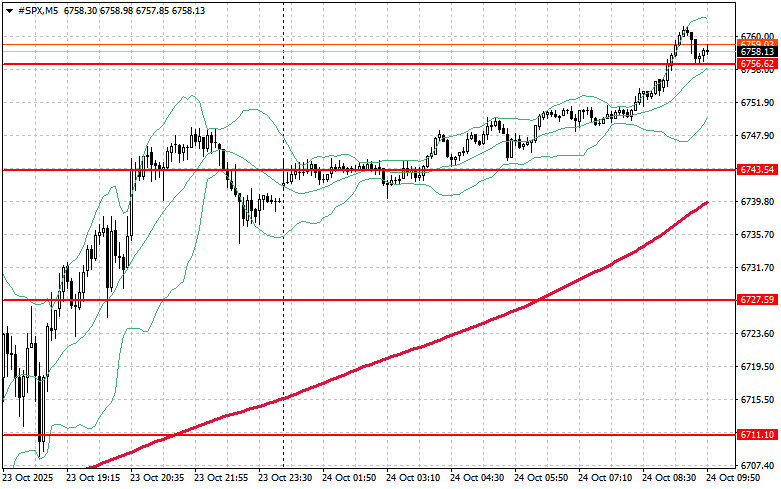

As for the technical picture of the S&P 500, the main objective for buyers today will be to break through the nearest resistance level of $6,769. A successful breakout would support further growth and open the path toward the next level at $6,784. An equally important task for bulls will be holding the $6,801 level, which would strengthen the buyers' position. In the event of a downward move driven by weakening risk appetite, bulls must step in around $6,756. A break below this level would quickly push the instrument back to $6,743 and open the door to $6,727.

QUICK LINKS