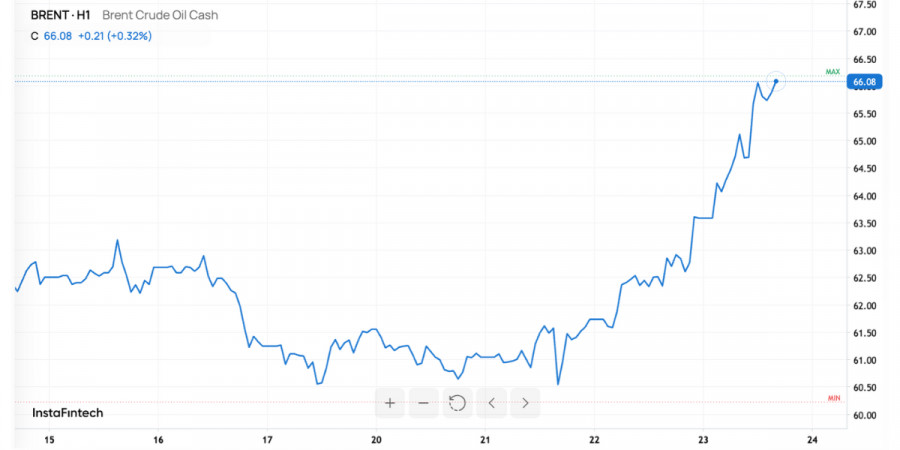

The market opened with notable upside. Brent climbed to the $65–66 per barrel range, reflecting an intraday gain of around 4–5%. European oil stocks also surged. The trigger was the announcement of new U.S. sanctions against Rosneft and Lukoil, alongside coordinated measures by allied countries targeting the so-called "shadow fleet" used to transport Russian crude. The market quickly priced in a risk premium, as any perceived threat to supply is immediately reflected in prices.

The primary catalyst: U.S. sanctions targeting major Russian oil exporters. The goal is clear—cut: Moscow's oil revenues. For the global market, this impacts a supply stream worth millions of barrels per day. News headlines about a "sanction shock" acted as a fuel pump for Brent's rally.

Additional restrictions from the U.K. amplified the move. These not only target companies, but also logistics—vessels, insurance, transshipment infrastructure, including parts of Asia's terminal network. When logistical links are disrupted, transaction costs rise, delays increase, and the market factors those into prices.

A third factor came from India, one of the largest buyers of Russian oil. Amid U.S. pressure, Indian refineries are reconsidering their sourcing strategy—shifting toward Middle Eastern and U.S. grades to replace part of the Russian supply. This lengthens transport routes, increases shipping costs, and temporarily creates a shortage of specific crude grades—another upward hook for prices.

Finally, China. Over the past few months, it has been building up strategic reserves to insulate itself from supply shocks. However, this accumulation has "dried up" excess barrels in Asia, making the market more sensitive to any supply disruptions. One new obstacle, and the upward price wave spreads more quickly than usual.

Market Balance: Less Supply, Uneven Demand

On the supply side, the market faces triple compression: direct restrictions on Russian flows, heightened logistics complexity after crackdowns on the shadow fleet, and India's ongoing rotation toward "clean" barrels. This results in additional costs and delays—reflected in a higher price premium.

Demand-wise, the picture is mixed. China's stockpiles act as a buffer, but the country's refining basket relies heavily on medium- and heavy-crude grades—an area where sanctioned Russian grades play a major role. Western regulators still forecast rising production from non-OPEC+ sources and growing commercial inventories into 2025–2026. Hence, near-term sanctions push prices higher, while medium-term fundamentals still pull Brent toward the $62–66 range.

Price, Company, and Flow Implications

For prices, the market enters a "price-in-risk-of-supply-disruption" mode. As long as headlines about sanctions persist, the $63–68 Brent range looks realistic. The upside will depend on the extent of secondary measures and how quickly Asian markets can adjust.

For companies: European oil majors and oil service firms are supported by expectations of stronger trading and refining margins. But trading firms now face higher operational risks—such as compliance, insurance, and cross-border payments. One verification error could lead to asset freezes or fines.

For flows: India will pay more for "clean" barrels and will have to diversify more aggressively. The spread between clean Middle Eastern grades and higher-risk alternatives will widen. The tanker market will rebalance toward longer routes, pushing up freight rates and extending delivery times.

Risks and Diverging Scenarios

The bullish risk: deeper sanctions and broader allied participation. Additional restrictions on ships, insurers, and terminals could trigger a short-term supply crunch, potentially adding another $2–4 to Brent.

The bearish risk: rapid market adaptation. Russia offers bigger discounts, intermediaries build "clean" pathways, and India and China shift sourcing efficiently. In that case, the price spike could fade quickly.

There's also a structural headwind: a projected increase in non-OPEC+ output and inventory build-up remains the core scenario. Without new shocks, this anchors Brent closer to the low $60s—a reason why investment banks are in no rush to revise price targets upward.

What to Watch Next

First, the tone and scope of new sanctions. Expanded blacklists of companies, ships, or insurers will reinforce the risk premium, second, real activity in India's tenders. If New Delhi materially reduces its intake of discounted Russian crude, this could offer more durable price support. Third, trends in Chinese reserves. If Beijing starts releasing stored barrels, that will dampen price spikes much faster.

Conclusion

The current price surge is largely a sanctions premium plus logistical bottlenecks—not a full-blown shift in the underlying trend. In the coming weeks, Brent is likely to stay within the $63–68 range, with heightened news-driven volatility. Strategically, however, the prevailing narrative remains one of oversupply into 2025–2026. If the waves of sanctions subside, fundamentals will once again pull oil back toward the lower $60s. This is the dilemma investors face: hedge against near-term supply risks, while staying mindful of medium-term gravitational pressures.

QUICK LINKS