The GBP/USD pair showed absolutely no interesting movement on Monday. While the euro (for unknown reasons) declined during the first half of the day, the British pound remained stationary throughout the day. However, overnight into Tuesday, the GBP/USD pair managed to break through a descending trendline, indicating a logical and long-awaited end to the descending trend.

Let us recall that in the past two weeks, the British currency had very few reasons to fall, while the U.S. dollar had few reasons to rise. We do not deny the necessity of occasional corrections—and on the daily timeframe, we do acknowledge the presence of a flat market. Therefore, the recent decline of the British pound can only be explained by technical factors. From a fundamental and macroeconomic perspective, the fall of the GBP/USD pair is entirely illogical. On Monday, there were no significant events or reports either in the UK or the U.S.

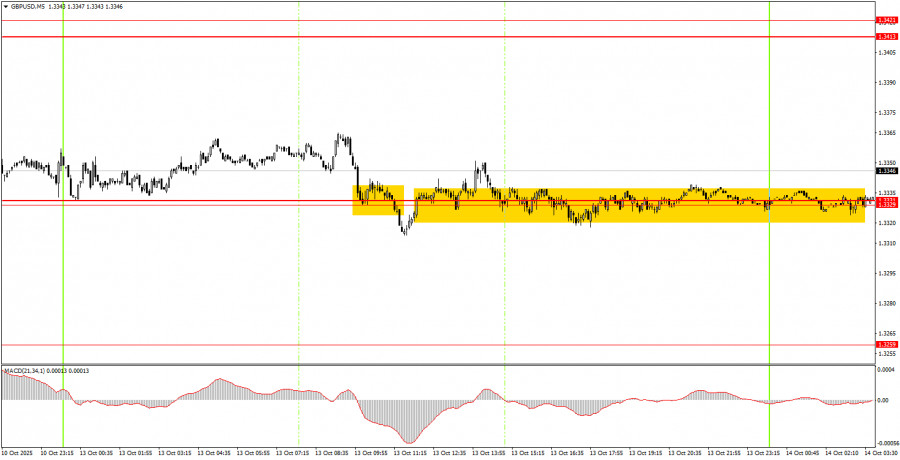

On the 5-minute timeframe, a sell signal was formed on Monday in the area of 1.3329–1.3331, but throughout the day, the price moved more sideways than up or down. The expected growth did not occur, but the anticipated flat did. Thus, novice traders may have attempted to open positions, but by the start of the U.S. session, it had become clear that no substantial movement would take place.

On the hourly time frame, the GBP/USD pair continues to emerge from a descending trend. As mentioned before, there is no reason to expect a prolonged U.S. dollar rally, so from a medium-term perspective, we anticipate movement only to the upside. However, the market remains in a very strange condition. The pound continues to drop, and there is no rational explanation for it—other than technical ones. Price action is often illogical.

On Tuesday, the GBP/USD pair may attempt to continue its upward movement since the trendline has been broken. A consolidation above the 1.3329–1.3331 area will also allow for the opening of long positions, even though the market ignored this zone throughout Monday.

On the 5-minute TF, you can now trade at levels 1.3102-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590, 1.3643-1.3652, 1.3682, 1.3763. For Tuesday, the UK is scheduled to release reports on unemployment, jobless claims, and wages. These reports are not the most critical under the current circumstances, but there aren't any others—due to the ongoing U.S. government shutdown, the U.S. Bureau of Statistics remains on forced hiatus. In the U.S., a speech by Federal Reserve Chair Jerome Powell is scheduled, which may be of some interest.

Important speeches and reports (always listed in the economic calendar) can strongly affect the movement of a currency pair. Therefore, during such events, it is recommended to trade with maximum caution or exit the market altogether to avoid sharp price reversals.

Beginner traders should remember that not every trade will be profitable. Developing a strict trading strategy and proper money management are key to long-term success in forex trading.

QUICK LINKS