There's a saying: "An irresistible force meets an immovable object." It describes an irreconcilable standoff where neither side is willing to compromise. In my view, Trump's "scythe," with which he planned to "trim" half the world, keeps hitting nothing but rocks.

Just consider the facts. Trump decided to revise trade terms with 75 countries, believing that these deals were unfavorable to the U.S. and that other nations were profiting off the American market. According to Trump, if a country sells $10 billion worth of goods to the U.S., it should also buy $10 billion worth in return. Clearly, all countries vary in size, industrial development, and population. So, a zero trade balance—especially with every U.S. partner—is pure fantasy. Still, the Republican leader holds his own views on many seemingly obvious matters.

So Trump began to "mow the field," only to discover that nearly all U.S. trading partners responded to his tariffs with their own tariffs. In other words, his scythe kept striking stones in the form of retaliatory measures. When his blitzkrieg approach failed, Trump pulled back and generously granted countries a three-month window of reduced tariffs to negotiate new trade deals. Two and a half months have passed—and the only deal signed is with the UK, which was expected from the beginning.

Notably, most tariffs on British goods remain in place. The new trade conditions were softened from the initial demands, but Trump still succeeded in getting most of his ultimatums met. Whether this is beneficial to the UK is debatable, but it seems London—after a decade of economic shocks—didn't want to sink into another quagmire.

Among other "fields" Trump tried to mow were geopolitical ones. He promised to end the war between Ukraine and Russia. He didn't. He pledged to dismantle Iran's nuclear arsenal. He didn't—but he did raise tensions in the region. He said he would lower taxes for Americans but, in reality, increased them via tariffs. He vowed to make Americans "great and rich again," yet the country now faces widespread protests and rallies. In my opinion, demand for the U.S. dollar will continue to decline in 2025 amid this news background and the results—or lack thereof—of the American leader's actions.

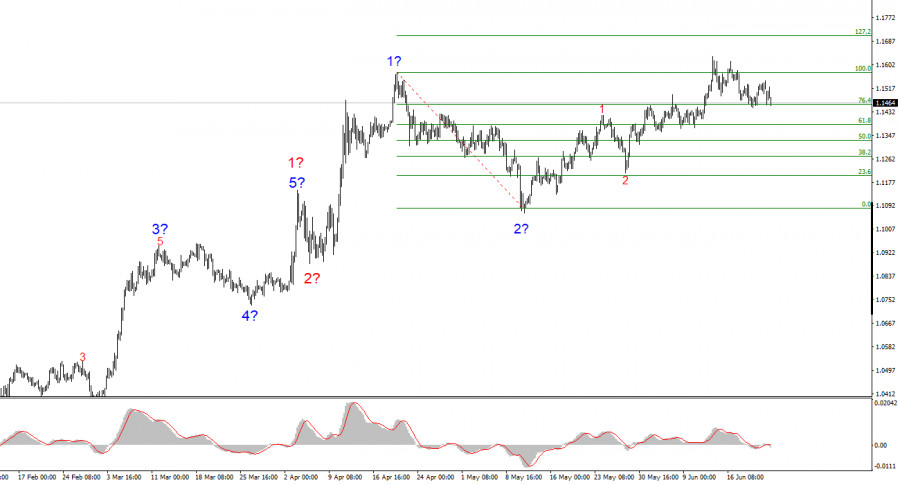

Based on the analysis of EUR/USD, I conclude that the instrument continues to develop a bullish trend segment. The wave structure remains heavily influenced by news events, especially Trump's decisions and U.S. foreign policy. The targets of wave 3 may extend to the 1.25 level. Therefore, I continue to favor buying, with the initial targets around 1.1708, corresponding to 127.2% Fibonacci. De-escalation of the trade war could reverse the upward trend, but there are no signs of reversal or de-escalation. The Iran-Israel war has halted the dollar's decline, but I don't believe it will reverse it.

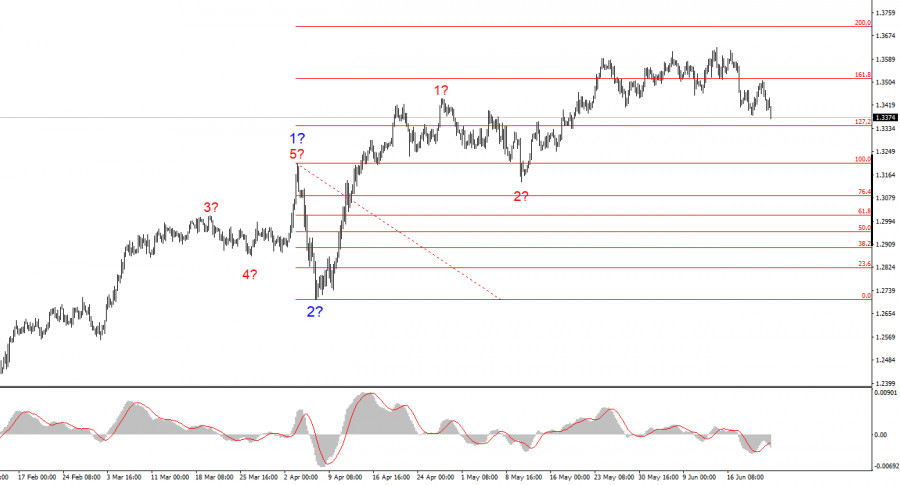

The wave pattern of GBP/USD remains unchanged. We are dealing with a bullish, impulsive trend segment. Under Trump, the markets may face numerous shocks and reversals, which could significantly alter the wave picture, but the working scenario remains intact at this point. Trump continues to act in ways that weaken demand for the dollar. The targets for the third upward wave are around 1.3708, corresponding to 200.0% Fibonacci from the assumed global wave 2. Therefore, I continue to favor buying, as the market shows no inclination to reverse the trend.

QUICK LINKS