It couldn't get worse. Bitcoin's consolidation is dragging on, and time is not working in favor of the bulls in BTC/USD. According to Glassnode, unrealized losses have jumped from an average of 2% to 4.4%. This indicates that the cryptocurrency's rally is being exploited by trapped buyers near record highs to liquidate losing positions. The potential for a rebound in this digital asset is limited, while the likelihood of continued downward movement appears much more probable.

Bitcoin's dynamics and unrealized losses

The bulls' desire to get rid of losing long positions in BTC/USD can explain why Bitcoin is ignoring positive news. This includes Michael Saylor's record purchase of Strategy tokens since June, the Commodity Futures Trading Commission's permission to use cryptocurrency as collateral for derivative transactions, and Vanguard opening access to trade crypto funds on its platform.

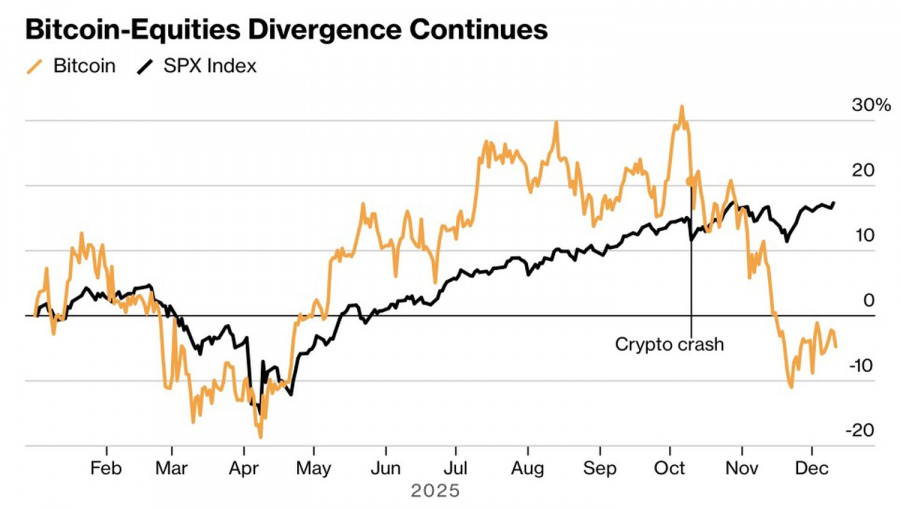

The consolidation of BTC/USD evokes memories of the crypto winter, which threatens to last—especially at lower levels. Bitcoin is receiving no aid from the Fed's decision to lower the federal funds rate or Donald Trump's attacks on the central bank, which weaken the US dollar. The cryptocurrency's correlation with US stock indices is becoming increasingly weak. This situation has brought back discussions about the essence of digital assets.

Dynamics of the S&P 500 and Bitcoin

According to Vanguard, which manages $12 trillion in assets, Bitcoin is not suitable for long-term investments. It does not generate interest income, and there is no discounting of cash flows that companies seek in other financial market assets. Cryptocurrency is more of a digital toy than anything else. No one really knows if it's laughing or crying.

The fact that digital assets remain under pressure is also confirmed by a 66% decline in trading volumes from the highs reached in January. Additionally, the capability of cryptocurrencies to absorb large trades without significant price changes—known as market depth—has fallen by 30% for both Bitcoin and Ethereum.

An asset that was previously purchased simply because it was rising has now fallen out of favour due to its inability to continue growing. As a result, the correlation of BTC/USD with US stock indices is decreasing, and attempts by Bitcoin to mount a counterattack are swiftly quashed by bulls who are now in a difficult position due to purchases made near record highs.

Cryptocurrency needs a fresh driver to perk up from this sleepy state. However, it is nowhere to be found. Good news fails to lead to price increases, suggesting that the market considers it insignificant.

Technically, on the daily chart, BTC/USD is consolidating within a "Spike and Shelf" pattern based on 1-2-3. Traders should consider placing two pending orders: one to buy the token at $94,000 and another to sell it at $87,500.

QUICK LINKS