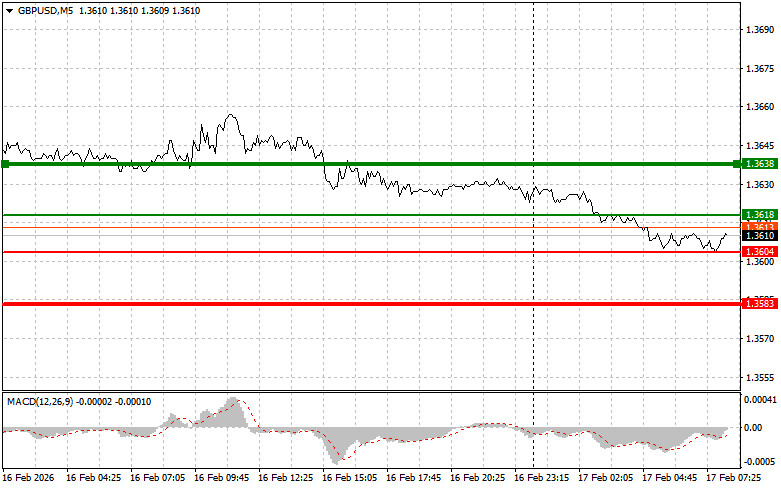

The test of the price at 1.3638 coincided with the moment when the MACD indicator had moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the pound.

Yesterday was a holiday in the U.S., so all movements can be retraced at the moment. Today, traders will definitely pay attention to the UK, where key labor market figures will be released. In January of this year, unemployment claims are expected to rise to 22,800, up from 17,900 in December. If this figure exceeds the forecast, it will ignite fears of recession, weakening GBP/USD. The unemployment rate is forecasted to remain unchanged at 5.1%, which is also fairly negative for the pound.

However, the main focus will be on average earnings. The expected increase in this indicator is only 4.6%. This indicator signals inflationary risks: an exceeding result will reinforce the Bank of England's hawkish stance, which would support the GBP. A sharp decrease will open the door to rate cuts, further intensifying the downward trend in GBP/USD.

Regarding the intraday strategy, I will rely more on implementing scenarios 1 and 2.

Scenario 1: I plan to buy the pound today upon reaching an entry point around 1.3618 (green line on the chart) with a target growth to the level of 1.3638 (thicker green line on the chart). Around 1.3683, I plan to exit the long position and open a short position in the opposite direction (expecting a move of 30-35 pips in the opposite direction from the level). Growth in the pound today can only be expected after strong labor market data. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario 2: I also plan to buy the pound today if the price tests 1.3604 twice in a row while the MACD indicator is in the oversold territory. This will limit the pair's downside potential and lead to a market reversal. Growth can be expected towards the opposite levels of 1.3618 and 1.3638.

Scenario 1: I plan to sell the pound today after breaking the level of 1.3604 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.3583 level, where I intend to exit the short position and immediately buy in the opposite direction (expecting a 20-25-pip move in the opposite direction from the level). Sellers of the pound will manifest themselves in the event of poor data. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline from it.

Scenario 2: I also intend to sell the pound today if the price tests 1.3618 twice in a row, when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downwards. A decline can be expected towards the opposite levels of 1.3604 and 1.3583.

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, as outlined above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

RYCHLÉ ODKAZY