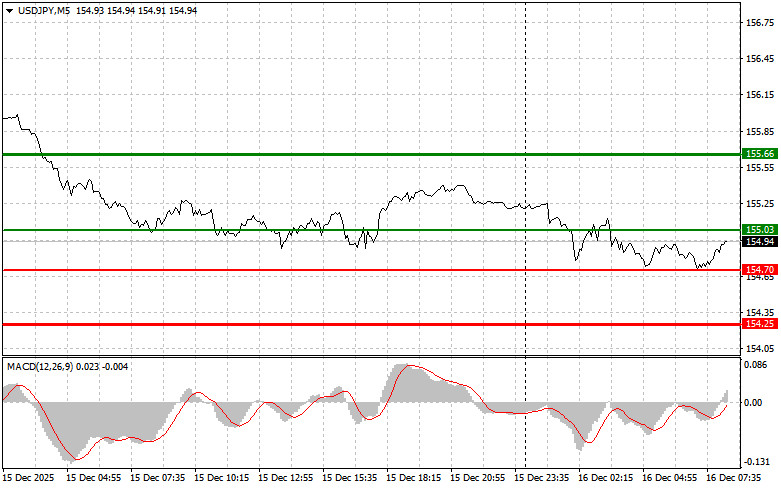

The price test at 155.01 coincided with the MACD indicator just starting to move downward from the zero mark, confirming a good entry point to sell the dollar. However, after the pair declined by 10 pips, the pressure eased.

The Japanese yen strengthened against the dollar after Japan's PMI data for manufacturing and services came in better than expected. The yen is also supported by increased expectations for a rate hike from the central bank later this week.

Investors will continue to pay close attention to the central bank's signals regarding its next steps. Given rising inflation and improving economic indicators, many analysts believe the Bank of Japan may adjust its monetary policy at the upcoming meeting. Currently, the probability of a rate hike stands at 94%. If the BOJ indeed raises interest rates, the yen will strengthen and put pressure on the dollar. In the short term, the dynamics of the USD/JPY pair will depend on further statements from the BOJ and macroeconomic data.

I would like to remind you that just yesterday, the BOJ highlighted progress in wage growth, a key factor supporting the case for an interest rate hike. The report showed that, despite US tariffs, wages in Japan continue to rise.

Regarding the intraday strategy, I will primarily focus on scenarios No. 1 and No. 2.

Scenario No. 1: I plan to buy USD/JPY today upon reaching the entry point around 155.03 (the green line on the chart), targeting a move to 155.66 (the thicker green line on the chart). At around 155.66, I intend to exit my long positions and open short positions in the opposite direction, targeting a move of 30-35 pips from that level. It is best to resume buying the pair on corrections and on serious dips in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from there.

Scenario No. 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the price at 154.70 while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal upwards. We can expect growth to the opposite levels of 155.03 and 155.66.

Scenario No. 1: I plan to sell USD/JPY today only after breaking the level of 154.70 (the red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the 154.25 level, where I plan to exit my short positions and immediately open long positions in the opposite direction, targeting a move of 20-25 pips from that level. It is better to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting its decline from there.

Scenario No. 2: I also plan to sell USD/JPY today in the event of two consecutive tests of the price at 155.03 while the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downwards. We can expect a decline to the opposite levels of 154.70 and 154.25.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.

RYCHLÉ ODKAZY