Úsilí o pokrok v oblasti fyzické umělé inteligence ve Spojených státech bude podle analytiků Morgan Stanley záviset na pokračující spolupráci s Čínou.

Banka v této týdnu uvedla, že navzdory nedávnému uvolnění celních napětí po ženevských obchodních jednáních nemohou dlouhodobé ambice USA v oblasti fyzické AI uspět izolovaně.

„Čína má podle našeho názoru ve srovnání s USA záviděníhodnou pozici v pokročilé výrobě související s umělou inteligencí,“ napsala Morgan Stanley. „Nebyla by pro nás překvapením významná spolupráce mezi americkými a čínskými výrobními firmami v oblasti čínských technologií vyráběných na území USA.“

Zpráva zdůraznila společnost Tesla (NASDAQ:TSLA) jako možného lídra v podpoře této spolupráce. „Tesla může mít jedinečnou pozici“ pro usnadnění kooperativního vstupu čínských výrobních technologií na americký trh, uvedli analytici.

The euro and the pound held their ground against the U.S. dollar, though risk assets came under pressure towards the end of U.S. trading. The lack of U.S. data adversely affected the dollar's positions, providing slight support to the euro and the pound at the start of the North American session, but the pressure on the pairs soon returned. Traders were deprived of an important benchmark for assessing the state of the American economy, which created uncertainty and made them cautious. Typically, the publication of macroeconomic data, such as employment levels, inflation, and GDP figures, serves as a compass indicating market direction. In the absence of this data, market participants tend to shift to other assets, as occurred in this case.

Today, an interesting report on Germany's third-quarter GDP is scheduled for release in the first half of the day. This event will undoubtedly attract the attention of traders and economists, as Germany is the locomotive of the European economy, and its indicators significantly impact the overall situation in the Eurozone. Although preliminary data have already been published, today's detailed report will allow for a more accurate assessment of the German economy amid the ongoing energy crisis and complex geopolitical situation. Analysts will closely examine the structure of GDP to understand which sectors of the economy are showing resilience and which are facing the most challenges. Particular attention will likely be given to industrial production, export, and consumer spending figures, as these are key growth drivers. The report's results could significantly influence the euro's exchange rate.

Regarding the pound, a report on retail sales from the Confederation of British Industry will be released in the first half of the day. This report serves as an indicator of consumer sentiment and the state of the British economy. A careful analysis of the data will help assess how successfully retailers are coping with inflation-related challenges and overall economic uncertainty. The CBI report will reflect changes in sales volume, retail stock levels, and retailers' expectations for the coming months. Traders will closely study the balance between positive and negative responses to determine whether signs of growth or decline prevail in the sector. In the case of very weak data, pressure on GBP/USD will return.

If the data aligns with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data is significantly above or below economists' expectations, it is best to use the Momentum strategy.

Buy on a breakout above 1.1522, which may lead to an increase in the euro towards 1.1550 and 1.1585.

Sell on a breakout below 1.1510, which may lead to a decline in the euro towards 1.1480 and 1.1460.

Buy on a breakout above 1.3114, which may lead to an increase in the pound towards 1.3135 and 1.3165.

Sell on a breakout below 1.3095, which may lead to a decline in the pound towards 1.3060 and 1.3035.

Buy on a breakout above 156.85, which may lead to an increase in the dollar towards 157.10 and 157.40.

Sell on a breakout below 156.60, which may lead to a decline in the dollar towards 156.25 and 155.80.

Look for sales after an unsuccessful breakout above 1.1538 on a return below this level.

Look for purchases after an unsuccessful breakout below 1.1505 on a return above this level.

Look for sales after an unsuccessful breakout above 1.3121 on a return below this level.

Look for purchases after an unsuccessful breakout below 1.3082 on a return above this level.

Look for sales after an unsuccessful breakout above 0.6473 on a return below this level.

Look for purchases after an unsuccessful breakout below 0.6449 on a return above this level.

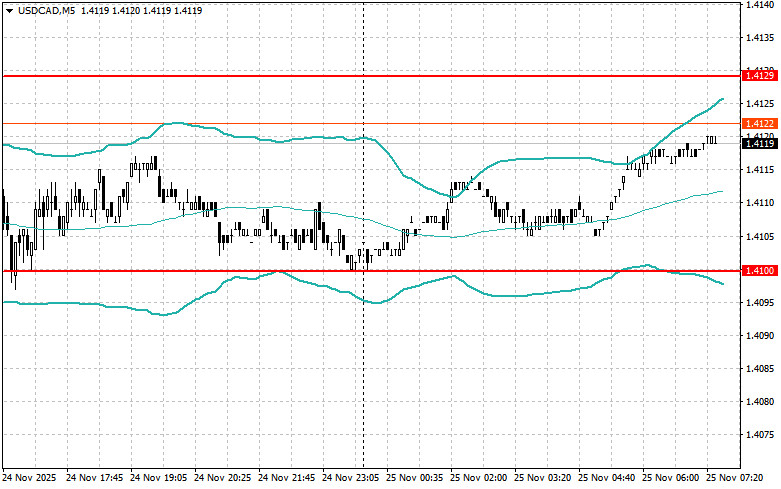

Look for sales after an unsuccessful breakout above 1.4129 on a return below this level.

Look for purchases after an unsuccessful breakout below 1.4100 on a return above this level.

RYCHLÉ ODKAZY