Barclays již neočekává, že americká ekonomika v letošním roce upadne do recese, a revidovala své prognózy růstu vzhůru, vzhledem k známkám uklidnění obchodních napětí mezi USA a Čínou, uvedla banka ve zprávě zveřejněné ve čtvrtek večer.

Barclays nyní očekává, že americká ekonomika letos poroste o 0,5 % a příští rok o 1,6 %, což je oproti předchozím prognózám -0,3 % a 1,5 % zlepšení.

Snížená nejistota a zlepšené ekonomické podmínky vedly Barclays také ke zvýšení prognóz růstu eurozóny. Nyní očekává pro letošní rok stagnující ekonomický růst, oproti předchozímu poklesu o 0,2 %.

Barclays poznamenala, že stále očekává technickou recesi eurozóny ve druhé polovině roku 2025, ale s nižším poklesem růstu, než se původně předpokládalo.

„Celkově zůstáváme pesimističtí ohledně výhledu růstu v eurozóně, protože nejistota zůstává velmi vysoká a jednání o vzájemných clech mezi Evropskou unií (EU) a USA zůstávají na technické úrovni a nejsou patrné žádné známky pokroku,“ uvedla Barclays v prohlášení.

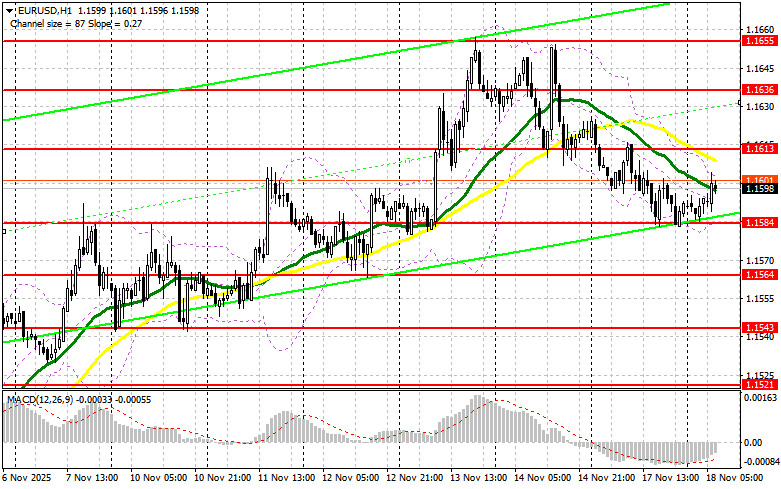

Yesterday, only one entry point into the market was formed. Let's take a look at the 5-minute chart and analyze what happened. In my morning forecast, I pointed out the level of 1.1591 and planned to make market entry decisions based on it. A decline occurred, but the price did not reach the 1.1591 test, so I had no trades in the first half of the day. In the second half of the day, I waited for the 1.1591 update and bought there on a false breakout, but there was no significant growth in the pair.

Strong data on the Empire Manufacturing Index's growth in the U.S. and statements from Federal Reserve officials on cautious interest rate cuts helped the U.S. dollar gain ground against the euro yesterday. Unfortunately, there is no macroeconomic data scheduled for the Eurozone in the first half of the day, so volatility in the EUR/USD pair will remain low. For this reason, I expect to see the first sign of buyers only near the new support level of 1.1584, formed during yesterday's session. If a false breakout forms there, it will provide an entry point for long positions, targeting further recovery of the pair to the 1.1613 resistance level. A breakout and retest of this range will confirm the validity of buying EUR in anticipation of a larger jump towards 1.1636. The furthest target will be last week's high of 1.1655, where I will secure profits. Testing this level will strengthen the euro's bullish market. In the event of a decline in EUR/USD and a lack of activity around 1.1584, pressure on the pair will intensify, potentially triggering a larger sell-off. Sellers will likely reach the next interesting level of 1.1564. Only if a false breakout forms there will it be an appropriate condition for buying the euro. Long positions will be opened right on the bounce from 1.1543, targeting an upward correction of 30-35 pips intraday.

Sellers continue the correction, which at any moment may evolve into a new bear market. Given the lack of key reports, the initial task will be to defend the 1.1613 resistance level. If a false breakout forms there, it will provide an entry point for short positions with a target move towards support at 1.1584. A breakout and consolidation below this range, along with a retest from below, would give another suitable option for opening short positions with movement toward 1.1564. The furthest target will be the 1.1543 area, where I will secure profits. If there is an upward movement in EUR/USD, and no active sellers at 1.1613, where the moving averages are aligned with the bears, it would be best to postpone short positions until reaching the larger level of 1.1636. Selling there will only occur after an unsuccessful consolidation. I plan to open short positions immediately on the bounce from 1.1655, targeting a 30-35-pip downward correction.

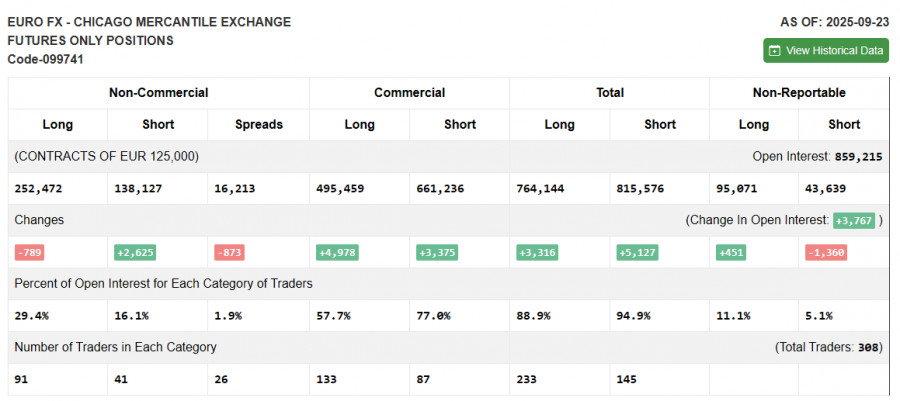

Due to the U.S. shutdown, fresh Commitment of Traders (COT) data is not being published. The latest data is only relevant as of September 23.

In the COT report for September 23, there was an increase in short positions and a reduction in long positions. Expectations of further Federal Reserve rate cuts continue to pressure the U.S. dollar. However, the number of euro buyers has also not increased, as political issues in France and the risk of new inflationary pressures force the European Central Bank to act much more cautiously, slowing economic growth. The COT report indicates that long non-commercial positions decreased by 789 to 252,472, while short non-commercial positions rose by 2,625 to 138,625. As a result, the spread between long and short positions narrowed by 873.

RYCHLÉ ODKAZY