Akcie společnosti Schindler ve středu vzrostly o více než 7 % poté, co výrobce výtahů a eskalátorů oznámil silné výsledky za první čtvrtletí, podpořené růstem objednávek a ziskovosti ve většině regionů.

Objednávky vzrostly v místních měnách o 6 % na 2,95 miliardy CHF a překonaly konsenzuální odhad o 5 %. V Americe a Asii (bez Číny) rostly objednávky na nové instalace o více než 10 %.

Evropa mírně vzrostla, zatímco Čína zaznamenala pokles o více než 10 %. Objednávky na modernizace vzrostly o více než 10 %, objem služeb se zvýšil o 0 % až 5 %.

Tržby v místních měnách vzrostly o 2,5 % na 2,73 miliardy CHF, což bylo o 1 % nad očekávání. Upravený provozní zisk před úroky a daněmi činil 333 milionů CHF, což je také o 5 % více, než se čekalo.

To znamenalo marži 12,2 %, tedy o 40 bazických bodů více, než činil konsenzus, a o 110 bazických bodů více než loni.

Analytici uvedli, že překonání odhadů bylo dáno lepším cenovým nastavením, vyšší provozní efektivitou a absencí restrukturalizačních nákladů.

Provozní cash flow meziročně vzrostl o 7 % na 540 milionů CHF díky vyšším ziskům a stabilnímu pracovnímu kapitálu.

Objem nevyřízených objednávek se meziročně v místních měnách zvýšil o 2 % na 8,34 miliardy CHF. Na konci roku 2024 činil 8,66 miliardy CHF.

Společnost potvrdila výhled pro rok 2025: očekává nízký jednociferný růst tržeb v místních měnách a provozní marži kolem 12 %.

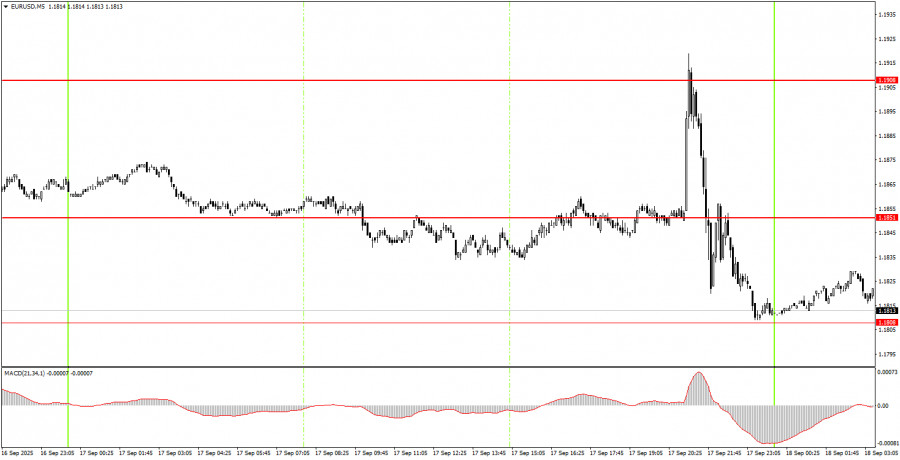

The EUR/USD pair traded on Wednesday fully in line with the fundamental background. For almost the entire day, market movements were ultra-weak, as traders awaited the results of the Fed meeting and Jerome Powell's press conference. All other events of the day were irrelevant, even though another set of weak U.S. reports was published — this time in the construction sector. After the Fed's decision was announced, "fireworks" began. As we warned, volatility increased, and the price moved in both directions. First, the dollar dropped 70 pips in 10 minutes, then strengthened by 100 pips over the next several hours. Today, it may well return to its starting positions around 1.1851, as the Fed delivered the most basic and widely expected scenario. That is why we always say that an event like the Fed meeting should be analyzed with conclusions drawn about a day later, once the emotional moves settle.

On the 5-minute TF on Wednesday, there was no sense in entering the market. If a good signal had formed in the first half of the day, it could have been traded, and before the Fed meeting, a Stop Loss could have been placed at breakeven. However, no good signals appeared. The only thing that beginner traders could have worked with was the consolidation below 1.1851 during the European session.

On the hourly timeframe, EUR/USD still has every chance to continue its uptrend despite yesterday's drop. The fundamental and macroeconomic background for the U.S. dollar remains negative, so we still do not expect the U.S. currency to strengthen. In our view, as before, the dollar can only count on technical corrections. The Fed meeting did not change the dollar's outlook in any way.

On Thursday, the EUR/USD pair may resume its upward movement, since the trend remains bullish. From the 1.1808 level (if a rebound occurs), long positions may be opened with targets at 1.1851 and 1.1908. Short positions will become relevant if the price consolidates below 1.1808, with a target at 1.1737–1.1745.

On the 5-minute TF, the following levels should be considered: 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1737–1.1745, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. On Thursday, another speech by Christine Lagarde is scheduled in the Eurozone, but it will have no significance for traders. In the U.S., there will be only a secondary jobless claims report. Today, all market attention will be focused on the Bank of England meeting.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

RYCHLÉ ODKAZY