On Wednesday, the GBP/USD pair traded relatively calmly until the evening. The evening events and subsequent movements will be analyzed later today, once the dust settles and traders digest all the information. For the pound, it may take another day, as the Bank of England's meeting is scheduled for today, which could also spark major market volatility. As a result, the pair may swing both ways for two consecutive days, movements that are unlikely to be considered systematic.

In the EUR/USD review, we discussed the "three doves" within the Fed—Mirran, Bowman, and Waller. These three are ready to vote at FOMC meetings exactly as Trump demands, and while the Fed is not supposed to be a "rubber stamp," it risks becoming one over time. Another problem lies with Trump's tariffs. Two U.S. courts have already recognized them as illegal, but neither dared overturn them, instead passing responsibility to the Supreme Court as the final authority. The Court consists of nine justices, six of whom were appointed either by Trump or other Republican presidents.

Thus, the U.S. Supreme Court could well become Trump's second "lapdog" after the Fed. In the coming months, we'll see whether this is the case. First, it must become clear whether Trump will continue trying to remove dissenting Fed officials. Second, in early November, the Supreme Court's ruling on tariffs will be revealed. If both scenarios go Trump's way, the dollar could plunge at breakneck speed.

Investors in such a case would realize that democracy in the U.S. no longer exists and that laws no longer work. What use are laws if even the Supreme Court rules "at the White House's call"? How much trust can the dollar hold if the Fed dances to the tune of a president who spends more time on golf courses than in the Oval Office? How much credibility can a president have if his main goal seems to be winning the Nobel Prize while breaking laws in the process?

Therefore, the rest of 2025 may turn out even worse for the dollar than its first half. On the daily chart, the uptrend will likely continue, as there are no valid reasons to think otherwise. In the short term, the dollar may rely only on technical corrections or support from isolated reports/events. The U.K. economy has been underwhelming for over a decade, and its macroeconomic data can indeed provoke GBP weakness. However, overall, the pound continues to rise simply because the dollar keeps falling.

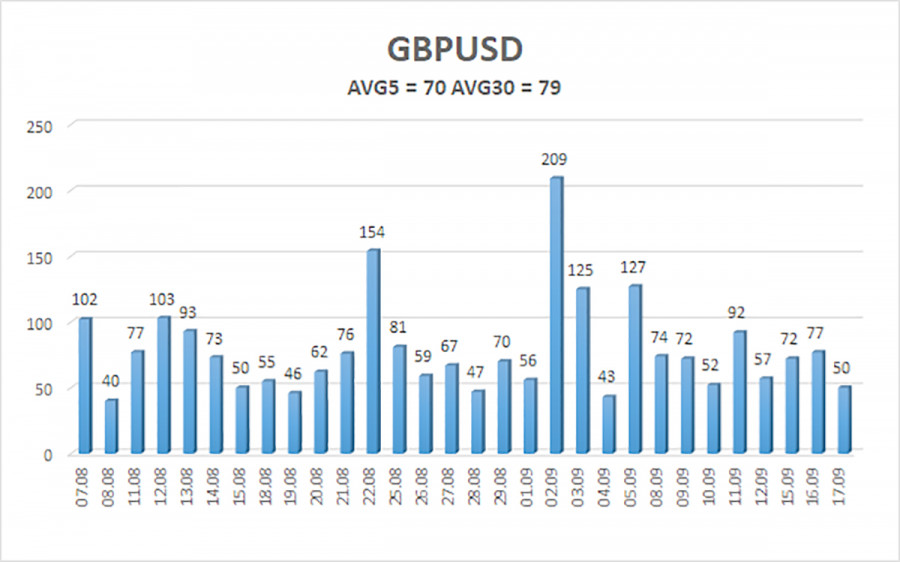

Average volatility of GBP/USD over the past five trading days is 70 pips, which is considered "average." On Thursday, September 18, we therefore expect the pair to move within the range defined by 1.3597 and 1.3737. The linear regression channel's upper band points upward, confirming a clear uptrend. The CCI indicator once again entered oversold territory, warning of trend resumption.

S1 – 1.3611

S2 – 1.3550

S3 – 1.3489

R1 – 1.3672

R2 – 1.3733

R3 – 1.3794

The GBP/USD pair is inclined to continue its uptrend. In the medium term, Trump's policies are likely to keep pressuring the dollar, so no sustainable growth in the U.S. currency is expected. Thus, long positions targeting 1.3733 and 1.3784 remain more relevant as long as the price holds above the moving average. If the price moves below the moving average, small shorts can be considered purely on technical grounds. From time to time, the dollar does show corrections, but trend-based strengthening requires clear signs of an end to the global trade war or other major positive factors.

RYCHLÉ ODKAZY