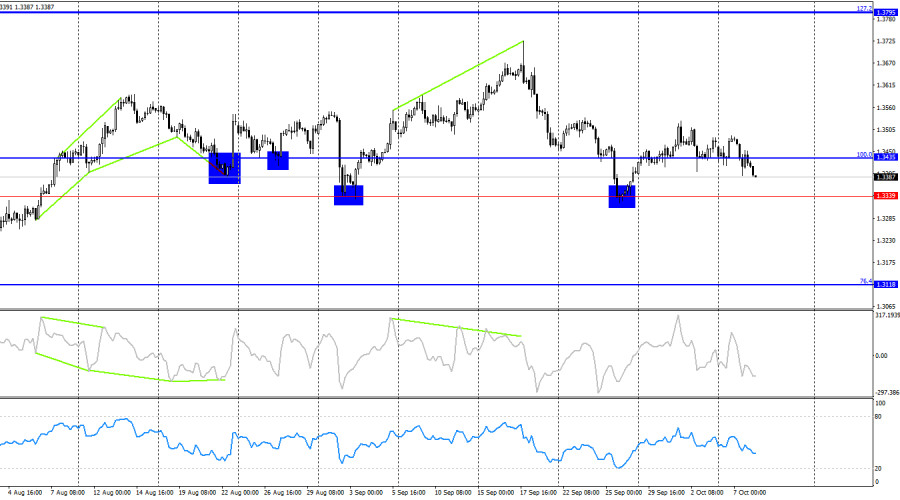

On the hourly chart, the GBP/USD pair on Tuesday rebounded from the 61.8% Fibonacci level at 1.3482, turned in favor of the U.S. dollar, and fell below the 76.4% corrective level at 1.3425. Thus, the decline may continue toward the support level of 1.3332–1.3357. A rebound from this zone would favor the pound and a move higher toward 1.3425, while a close below it would increase the likelihood of further decline toward the 127.2% Fibonacci level at 1.3225.

The wave structure remains "bearish." The last completed upward wave failed to break the previous peak, while the most recent downward wave did not break the previous low. The news background in recent weeks has been negative for the U.S. dollar, but bull traders have not yet taken advantage of the opportunities to push higher. To cancel the "bearish" trend, the pair would need to rise above 1.3528.

On Tuesday, nothing of interest occurred globally for either the pound or the dollar—aside from the ongoing U.S. government shutdown, which traders and the dollar are largely ignoring. Overall, this week is likely to be rather uneventful. Last week brought important U.S. economic figures such as business activity and labor market data. This week, not even the inflation report will be released, as the Bureau of Statistics is not operating due to the shutdown. Therefore, the most interesting events will be Jerome Powell's speech on Thursday and the FOMC minutes on Wednesday.

What to expect from the minutes? Recall that Fed officials are divided into "very dovish" and "moderately dovish" camps. Proponents of the former believe that more rapid monetary easing is necessary due to labor market weakness and the global downward pressure on the "neutral" rate. Advocates of the latter argue that aggressive rate cuts could fuel inflation, which must be avoided. The FOMC minutes may provide material for reflection regarding the Fed's upcoming meetings.

On the 4-hour chart, the pair returned to the 1.3339–1.3435 level. A rebound from 1.3339 would again favor the pound and a resumption of growth toward the 127.2% Fibonacci level at 1.3795. A close below 1.3339 would open the way for further decline toward the 76.4% corrective level at 1.3118. No emerging divergences are visible on any indicator today.

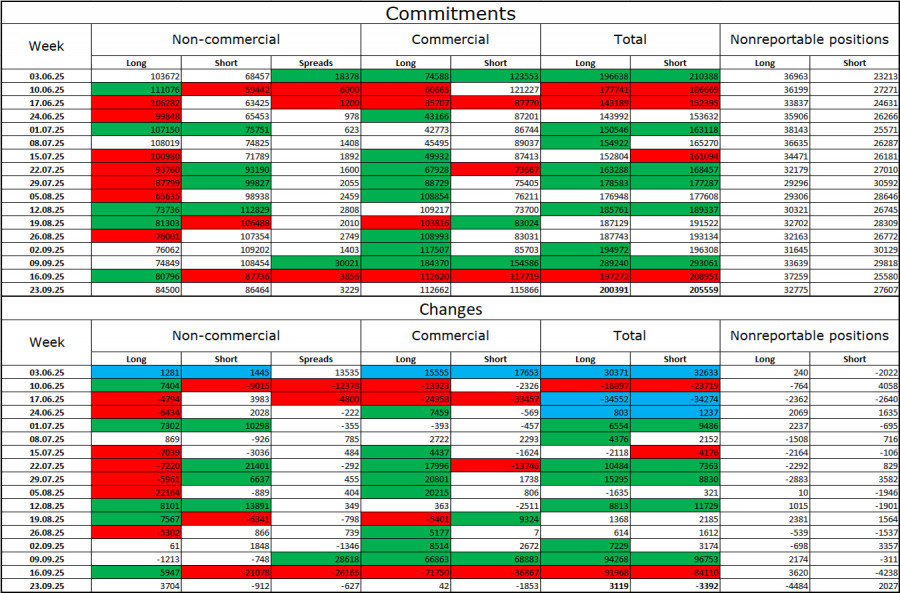

Commitments of Traders (COT) Report:

Sentiment among the "Non-commercial" category became more "bullish" over the latest reporting week. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The gap between long and short positions now stands at roughly 85,000 vs. 86,000. Bullish traders are again tilting the balance in their favor.

In my view, the pound still faces downward prospects, but with each passing month, the U.S. dollar looks weaker and weaker. Whereas traders once worried about Donald Trump's protectionist policies without knowing their eventual impact, now they may be concerned about the consequences: the possibility of recession, the constant imposition of new tariffs, and Trump's ongoing battle with the Fed, which could render the regulator "politically controlled" by the White House. Thus, the pound now looks much less threatening compared to the U.S. currency.

News Calendar for the U.S. and the UK:

On October 8, the economic calendar contains only one relatively minor entry. The influence of the news background on market sentiment will be weak on Wednesday, limited mostly to the evening.

Forecast for GBP/USD and trading advice:

Selling the pair was possible at the rebound from 1.3482 with targets at 1.3425 and 1.3357 on the hourly chart. New sales may be considered if the pair closes below 1.3425, targeting 1.3332–1.3357. Buying can be considered at a rebound from the 1.3332–1.3357 level with a target at 1.3425.

Fibonacci grids are built from 1.3332–1.3725 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

روابط سريعة